Welcome to our comprehensive guide on carbon markets, where we delve deep into the intricate world of carbon credits, offsets, and the dynamic carbon marketplace. In this extensive discourse, we aim to provide you with a nuanced understanding of carbon trading, its significance in mitigating climate change, and the evolving landscape of global emissions reduction efforts.

1. Introduction to Carbon Credits, Offsets, and Markets

The concept of carbon markets has gained significant traction in recent years, fueled by the pressing need to combat the escalating climate crisis. Carbon markets serve as innovative platforms where investors and corporations can trade carbon credits and offsets, thereby fostering environmental sustainability while unlocking new market opportunities. Originating from international agreements like the Kyoto Protocol and the Paris Agreement, carbon markets have witnessed a surge in interest and investment, with the emergence of both regional and voluntary markets.

2. Differentiating Carbon Credits and Carbon Offsets

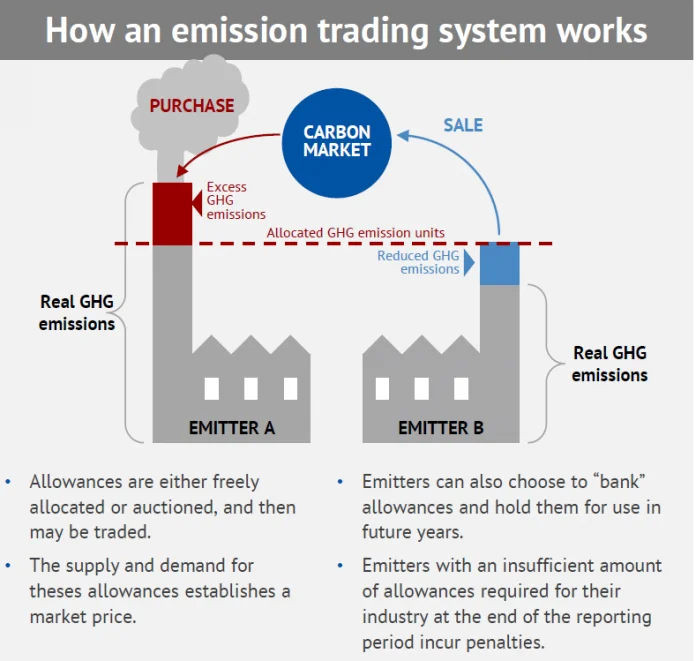

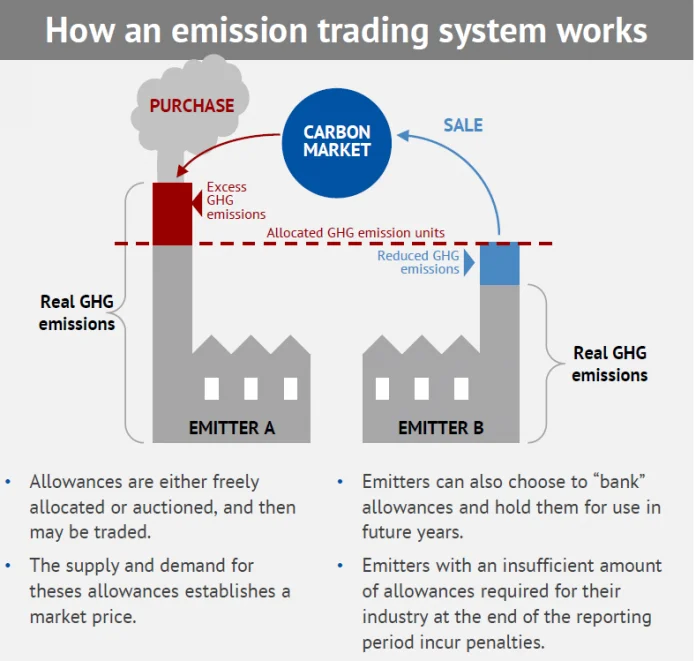

Carbon credits and offsets, although often used interchangeably, operate on distinct mechanisms within carbon markets. Carbon credits, also known as allowances, function as permission slips for emissions, enabling companies to emit a specified amount of CO2 within regulatory limits. On the other hand, carbon offsets facilitate emissions reduction by financing projects that sequester or avoid carbon emissions, thus providing a voluntary means for companies to offset their carbon footprint.

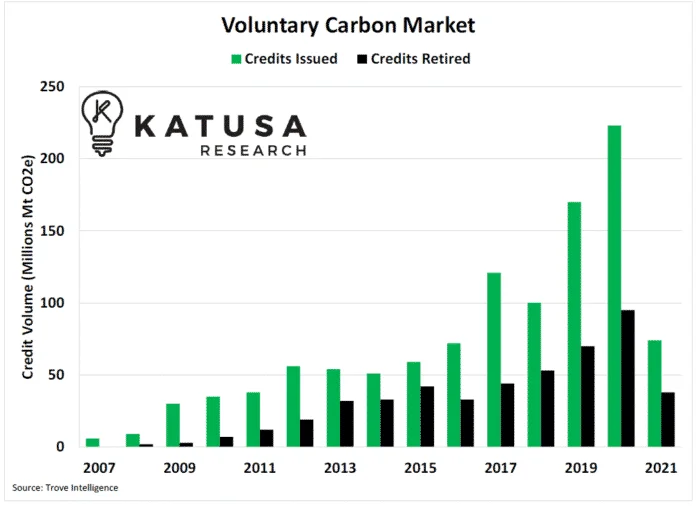

3. The Carbon Marketplace: Regulatory vs. Voluntary Markets

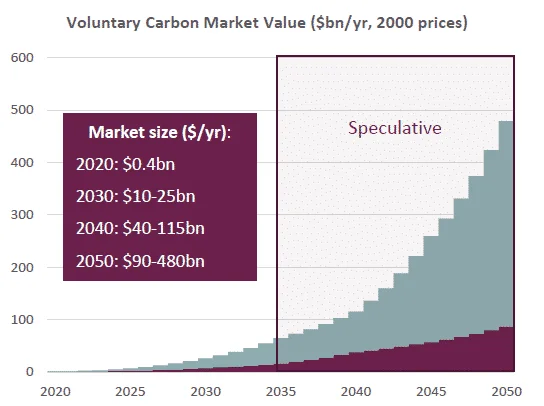

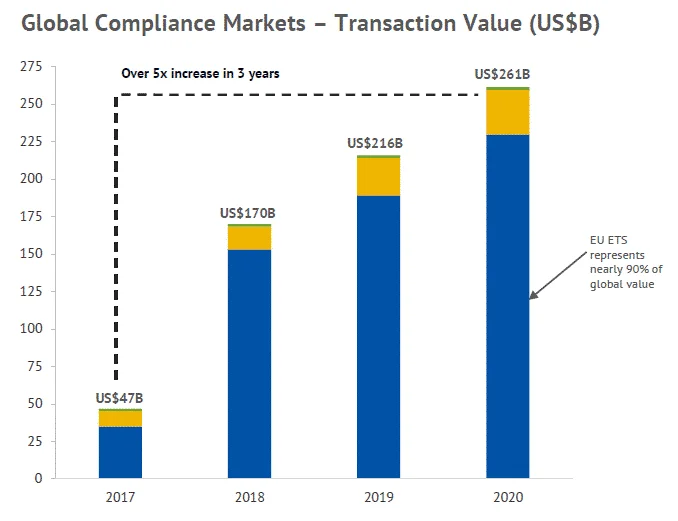

Carbon markets comprise both regulatory and voluntary segments, each serving distinct purposes in emissions reduction. Regulatory markets, governed by cap-and-trade programs, mandate emissions limits and facilitate the trading of carbon credits among companies to ensure compliance. In contrast, voluntary markets offer companies and individuals the flexibility to voluntarily offset their emissions through the purchase of carbon offsets, thus driving additional emissions reductions beyond regulatory requirements.

4. Understanding the Regulatory and Voluntary Markets

The regulatory market, characterized by mandatory emissions limits, encompasses diverse schemes such as the European Union Emissions Trading System (EU ETS) and California’s cap-and-trade program. Conversely, the voluntary market operates on the principle of corporate social responsibility (CSR) and consumer demand, with companies like Apple and Shell actively participating to offset their carbon footprint. As consumer awareness grows, companies increasingly view carbon offsets as a means to demonstrate environmental stewardship and enhance brand reputation.

5. Corporate Social Responsibility and Environmental Impact

In an era of heightened environmental consciousness, corporate social responsibility (CSR) plays a pivotal role in shaping consumer perceptions and investor confidence. By engaging in carbon offset projects, companies signal their commitment to environmental sustainability, thereby bolstering brand credibility and market competitiveness. Moreover, CSR initiatives enable companies to maximize their environmental impact and contribute meaningfully to global emissions reduction efforts.

6. Leveraging Carbon Offsets for Strategic Growth

Carbon offsets present a dual opportunity for companies: not only do they facilitate emissions reduction, but they also offer a lucrative revenue stream. Companies engaged in carbon offset projects, such as Tesla, can generate substantial income by selling carbon credits to entities seeking to offset their emissions. As the global carbon market continues to expand, environmentally conscious businesses stand to reap significant financial rewards while advancing sustainability objectives.

7. Evaluating the Efficacy of Carbon Offsets

Despite their potential benefits, carbon offsets must undergo rigorous scrutiny to ensure their efficacy in reducing emissions. High-quality offsets are characterized by transparent accounting practices, verifiable emission reductions, and adherence to stringent standards set by organizations like Verra. By investing in reputable offset projects, companies can effectively neutralize their carbon footprint and contribute to tangible emissions reductions, thus advancing global climate goals.

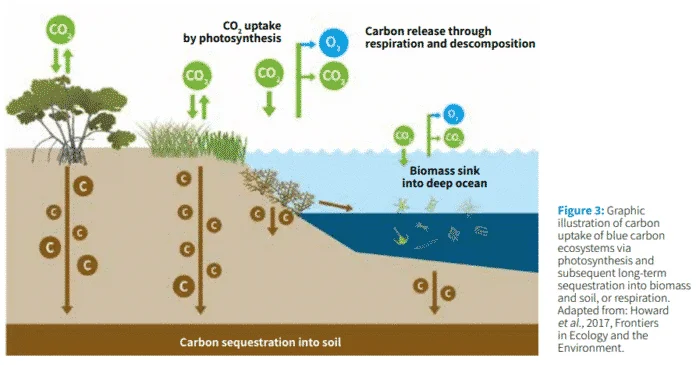

8. Harnessing Blue Carbon for Sustainable Solutions

Blue carbon ecosystems, encompassing coastal habitats like mangroves and seagrass beds, offer unparalleled potential for carbon sequestration and biodiversity conservation. These ecosystems, renowned for their ability to store vast amounts of carbon, present a unique opportunity for carbon offset projects. By investing in blue carbon initiatives, companies can not only mitigate their carbon footprint but also support ecosystem restoration and resilience against climate change impacts.

9. The Two Types of Global Carbon Markets: Voluntary and Compliance

Carbon markets are broadly categorized into two types: voluntary and compliance markets. The compliance market, governed by regulatory mandates, encompasses schemes like the European Union Emissions Trading System (EU ETS) and California’s cap-and-trade program. In contrast, the voluntary market operates on the principles of corporate social responsibility (CSR) and consumer demand, providing individuals and companies with the flexibility to offset their carbon footprint through voluntary participation.

10. Corporate Social Responsibility (CSR)

In an increasingly eco-conscious world, corporate social responsibility (CSR) has become paramount for companies seeking to enhance their reputation and stakeholder trust. By investing in carbon offset projects, companies demonstrate their commitment to environmental sustainability, thereby fostering goodwill among consumers and investors. Moreover, CSR initiatives enable companies to align their business objectives with broader societal goals, driving positive social and environmental impact.

11. Opportunity to Maximize Impact

While carbon credits offer a means to mitigate future emissions, carbon offsets present an opportunity for companies to address both current and historical emissions. By investing in high-quality offset projects, companies can achieve tangible reductions in greenhouse gas emissions and contribute to sustainable development goals. Moreover, companies have the flexibility to choose offset projects that align with their sustainability objectives, thereby maximizing their environmental impact.

12. The Offset Advantage: New Revenue Streams

Carbon offsets not only facilitate emissions reduction but also offer a lucrative revenue stream for companies engaged in offset projects. Tesla, for instance, has leveraged its position as a clean energy innovator to generate significant income from selling carbon credits to legacy car manufacturers. As the demand for carbon offsets continues to rise, environmentally conscious businesses stand to benefit financially while advancing sustainability objectives.

13. Do Carbon Offsets Actually Reduce Emissions?

The efficacy of carbon offsets hinges on the transparency and accountability of offset projects. While reputable offset organizations adhere to strict standards and undergo third-party verification, the effectiveness of offset projects varies. However, high-quality offsets represent tangible emissions reductions that contribute to global climate goals, providing companies with a valuable tool to mitigate their carbon footprint and drive environmental stewardship.

14. Can You Purchase Carbon Offsets as an Individual?

Individuals interested in offsetting their carbon footprint can do so through third-party intermediaries that facilitate the purchase of carbon offsets. These intermediaries not only provide access to offset projects but also ensure the credibility and transparency of offset transactions. By calculating their carbon footprint and purchasing offsets accordingly, individuals can actively participate in emissions reduction efforts and contribute to a more sustainable future.

15. Do I Need Carbon Offsets or Carbon Credits?

The need for carbon offsets or credits depends on various factors, including regulatory requirements and sustainability goals. While corporations may require both to comply with emissions regulations and demonstrate environmental responsibility, individuals can opt for carbon offsets to offset their personal carbon footprint. Ultimately, the choice between offsets and credits depends on individual circumstances and objectives, with both avenues contributing to global emissions reduction efforts.

16. Why Should I Buy Carbon Credits?

For environmentally conscious individuals and investors, purchasing carbon credits offers a tangible way to mitigate their carbon footprint and support emissions reduction projects. As the global carbon market continues to grow, investing in carbon credits not only promotes environmental sustainability but also presents an opportunity for financial growth. By aligning investment decisions with sustainability objectives, individuals can drive positive change while securing long-term returns.

17. What is Blue Carbon?

Blue carbon refers to carbon sequestration and storage in coastal and marine ecosystems such as mangroves, seagrass beds, and tidal marshes. These ecosystems play a crucial role in mitigating climate change by capturing and storing carbon dioxide from the atmosphere. Blue carbon offset projects leverage the carbon sequestration potential of coastal ecosystems to facilitate emissions reductions and support ecosystem conservation efforts.

18. Second Order Effects of Blue Carbon Credits

In addition to carbon sequestration, blue carbon ecosystems offer a range of ecosystem services and benefits, including coastal protection, biodiversity conservation, and water filtration. By investing in blue carbon initiatives, companies can not only mitigate their carbon footprint but also contribute to the resilience and sustainability of coastal ecosystems. Furthermore, the preservation of blue carbon habitats can enhance climate resilience and support the livelihoods of local communities dependent on coastal resources.

Navigating the Carbon Landscape

In conclusion, carbon markets represent a vital mechanism for driving emissions reductions and fostering sustainable development. By understanding the nuances of carbon credits, offsets, and market dynamics, companies can strategically navigate the carbon landscape and position themselves as leaders in climate action. As we embark on the journey towards a low-carbon future, embracing innovative solutions like blue carbon initiatives will be crucial in mitigating the impacts of climate change and securing a sustainable tomorrow for generations to come.

This comprehensive guide serves as a roadmap for companies and individuals seeking to engage meaningfully in carbon markets and contribute to global efforts towards a greener, more resilient planet. Let us embark on this journey together, forging a path towards a sustainable future for all.

Disclaimer: The information provided in this guide is for educational purposes only and does not constitute financial or investment advice. Readers are encouraged to conduct their own research and consult with relevant experts before making any investment decisions.